Платформа для инвестирования

с ЭДО и интеграцией с платежной системой банка

Проект — онлайн-платформа, которая переводит процесс инвестирования в недвижимость в цифровой формат и позволяет инвесторам и заемщикам взаимодействовать через персональные кабинеты. Платформа обеспечивает полный цикл — от подачи заявки на проект до перевода денег, подписания документов и отслеживания возврата. В итоге — автоматизация, прозрачность и снижение роли посредников.

Отрасль

Финтех

Дата

Фев. – Дек. 2022

Стоимость

> 5 млн руб.

Услуги

Верстка, Аутстаффинг, Frontend-разработка, Backend-разработка

Команда

2 разработчика

Технологии

PHP 8.1, Laravel 8, PostgreSQL, Redis, HTML, CSS, JavaScript, Vue 2, Nuxt.js, Node.js, CryptoPRO, Git, Docker, Docker Сompose

О клиенте

Компания более 10 лет занимается строительством коттеджных поселков и продажей загородных участков. Девелопер создает инфраструктуру своей территории и предлагает недвижимость в виде земельной площади с уже готовым домом или без него. Позиционирует свое решение как альтернативу городской жизни.

Находясь на рынке долгое время, компания активно развивается не только в своей профессиональной деятельности, но и в цифровом направлении. Один из нужных для этого IT-инструментов – ресурс, на котором можно получить заем на приобретение участка в коттеджном поселке для его последующей застройки и перепродажи.

Платформа должна стимулировать инвесторов и открыть возможность застройщикам и девелоперам реализовывать свои проекты благодаря внутренней автоматизированной системе финансирования.

Задача

Создать интернет-платформу с личными кабинетами пользователей и прозрачной системой инвестирования.

Разработать персональные кабинеты для инвесторов и заемщиков с функционалом автоматизации сделок: заявки, вложения, распределение средств, возврат.

Подключить и интегрировать безопасную систему платежей для приёма инвестиционных средств.

Внедрить электронный документооборот — чтобы все договоры, контракты, платежные акты, чеки создавались и подписывались в системе, без бумаги.

Цель: оцифровать и перенести реальную сделку между инвестором и заемщиком в виртуальное пространство, автоматизировать её с минимальным вовлечением посредников, при этом соблюдая все стадии и юридические требования.

Решение

Команда MediaTen подключилась к проекту в формате аутстаффинга (2 разработчика) для усиления штата клиента.

Была разработана функциональная часть бэкенда и осуществлена верстка сайта на основе подготовленных макетов.

Созданы индивидуальные личные кабинеты для Инвестора, Заемщика и Администратора, чтобы оцифровать и автоматизировать реальную сделку с минимальным участием посредника.

Внедрена интеграция со специализированной платежной системой для обеспечения безопасности и прозрачности денежных операций.

Подключен Электронный документооборот (ЭДО) с цифровой подписью (через «Диадок») для автоматической генерации и подтверждения всех договоров, платежей и актов в системе.

Клиент самостоятельно сформировал свою команду, укрепив штат нашими программистами для закрытия задач по разработке. Мы подключились к проекту в формате аутстаффинга IT-специалистов. На основе подготовленных макетов разработали функционал backend части и осуществили верстку сайта.

Компания стремилась оцифровать и перенести в виртуальное пространство реальную сделку между инвестором и заемщиком. Так, чтобы она происходила автоматизированно и с минимальным участием посредника. При этом процесс должен соответствовать не только этапам из обычной жизни, но и согласно закону.

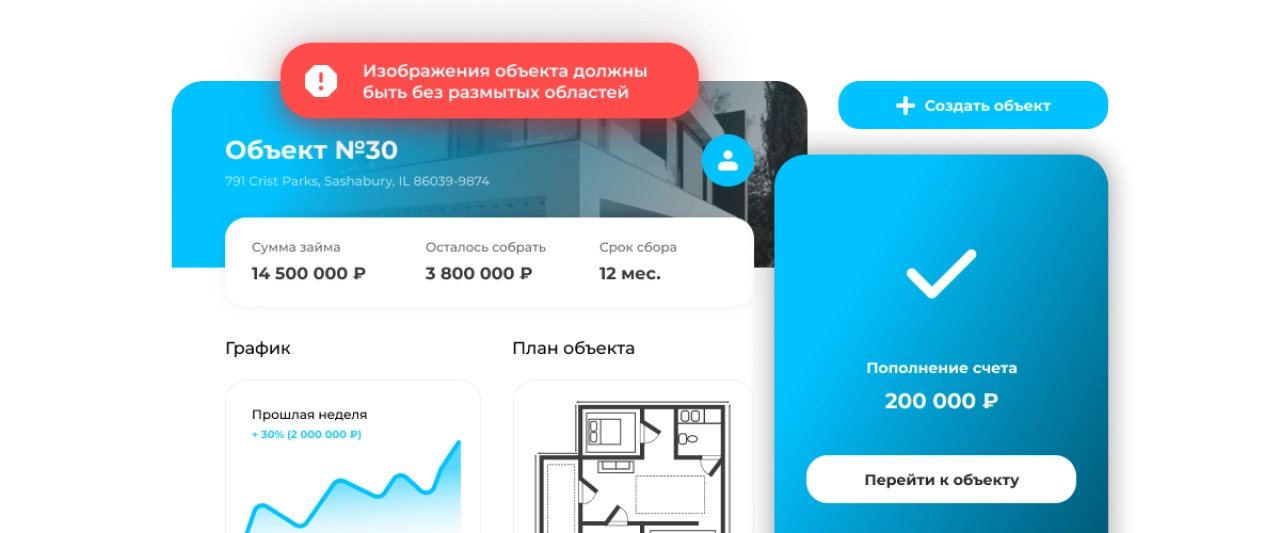

Доступ к платформе возможен только через личный кабинет. Он индивидуален для каждой категории пользователей: заемщика, администратора, инвестора.

Заемщик заходит в свой аккаунт, составляет и размещает запрос со сметой на определенный объект. Может добавить макеты и другие иллюстрации проекта будущего дома.

Администратор проверяет заявку и, если есть несоответствие информации принятым правилам, дает рекомендации заемщику для прохождения модерации.

Инвестор через свой ЛК смотрит предложения от застройщика, выбирает подходящее и пополняет счет на необходимую для сделки сумму.

Инвестировать в один проект могут сразу несколько лиц. Чтобы приобрести объект, застройщику необходимо за определенный срок собрать минимальную сумму денежных вложений. Если заявка отклоняется, то собранные средства возвращаются владельцам.

Для безопасного пополнения счета инвестора требовалась интеграция со специальной платежной системой.

На момент разработки платформы было всего два подходящих решения, которые позволяли реализовать необходимый функционал приема инвестиционных средств. Выбор среди них сделал клиент. После этого мы приступили к интеграции, но столкнулись с определенными проблемами. API платежной системы зачастую возвращало неверный ответ или вовсе сообщало, что данный метод отсутствует.

Благодаря помощи технической поддержки банка и переключению нас между тестовыми серверами мы смогли настроить безошибочное взаимодействие и завершить реализацию модуля.

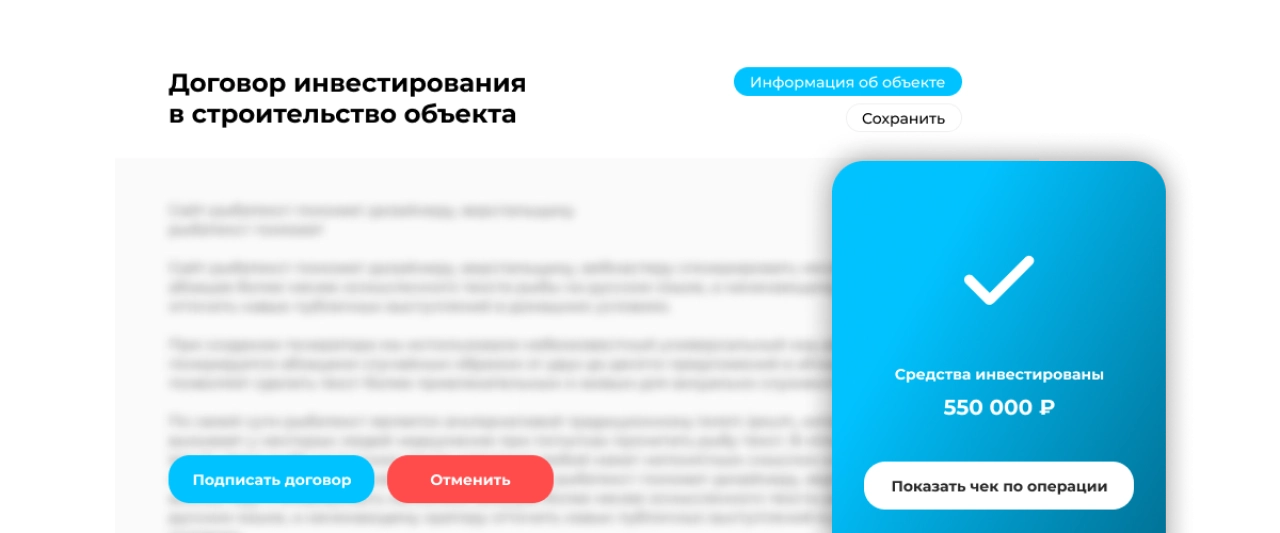

Интеграция платформы со специализированной платежной системой позволяет совершать непростые денежные операции достаточно прозрачно, а главное – законно. Гарантии правомерности сделок обеспечивает внедренный ЭДО с цифровой подписью и отправкой документов через Диадок.

Когда инвестор вкладывается в интересующее его предложение, ему приходит подтверждение операции и оформленный контракт сделки. В дальнейшем он будет получать через платформу сопроводительные чеки и акты по каждому платежу, присланному заемщиком.

Заемщик, получая денежные средства на объект, обязуется вернуть их согласно условиям кредитного договора. Если инвесторов несколько, то общая сумма займа с начисленными процентами делится по вкладчикам и периодам оплаты. Каждый возврат дебиторского долга заверяется соответствующим документом.

Реализованный функционал освобождает пользователя от бумажной волокиты и сторонней помощи. Ему достаточно ввести необходимые данные в шаблон и нажать на кнопку. Все договоры, платежи и акты генерируются и подтверждаются прямо в системе.

Результаты

Созданы персональные кабинеты для разных ролей (инвесторы, заемщики, администраторы) с функционалом автоматизации сделок.

Интегрирована инвестиционная платёжная система вместе с электронным документооборотом и электронной подписью, что обеспечивает законность и прозрачность инвестиционных операций.

![]() Хотите похожий результат?

Хотите похожий результат?

Не откладывайте — сделаем бесплатный аудит проекта уже сегодня. Напишите нам — обсудим детали за чашкой кофе.